How Do Small Businesses Create Financial Projections?

Creating Small Business Financial Projections

Financial projections are a tool you can use to gain insight into the future of your small business finances. There are numerous benefits to leveraging financial projections in your bookkeeping.

- You can run your business effectively and efficiently because you know what to expect in the coming months and can plan accordingly.

- You can plan and hire with confidence because you are well aware of how much you can afford to pay your team.

- You can handle problems that arise more smoothly if you understand the wiring of the business and where the money flows. Your financial projections make you better prepared to handle the unexpected!

- You can raise money to help your business grow because you have an in-depth understanding of your small business finances and can easily explain them to others.

Having financial projections in place as part of your small business finances can help you avoid difficult situations such as having to let go of employees due to no budget or having no buffer during economically tough times.

But how do you create your small business’ financial projections? There are four stages to establishing your long-term financial plan.

Stage 1:

Pulling numbers out of thin air → At first, you may need to estimate your company’s key performance indicators. This is the first step to mastering your small business finances! As you continue operating, you will have more historical data to pull from.

Stage 2:

Researching likely answers → One of the best ways to learn is to draw on the work of others! Research your competitors’ businesses and their prices as you begin your financial projections.

Stage 3:

Adjusting as you run your business → As you continue to operate your business, you can monitor your financial projects to see if they match the real-life numbers. If they don’t, update your numbers.

Stage 4:

Mastery based on experience and data → The longer your business operates, the more historical data you can refer to as you continue to make your financial projections. After several years of conducting business, you’ll be a pro at measuring where your finances are headed!

If all of this is new to you, the most important thing for you to do is build that mental model of your business. This is what is going to allow you to adjust as the landscape changes.

Want to read more about simplifying your small business finances? For more information, click here.

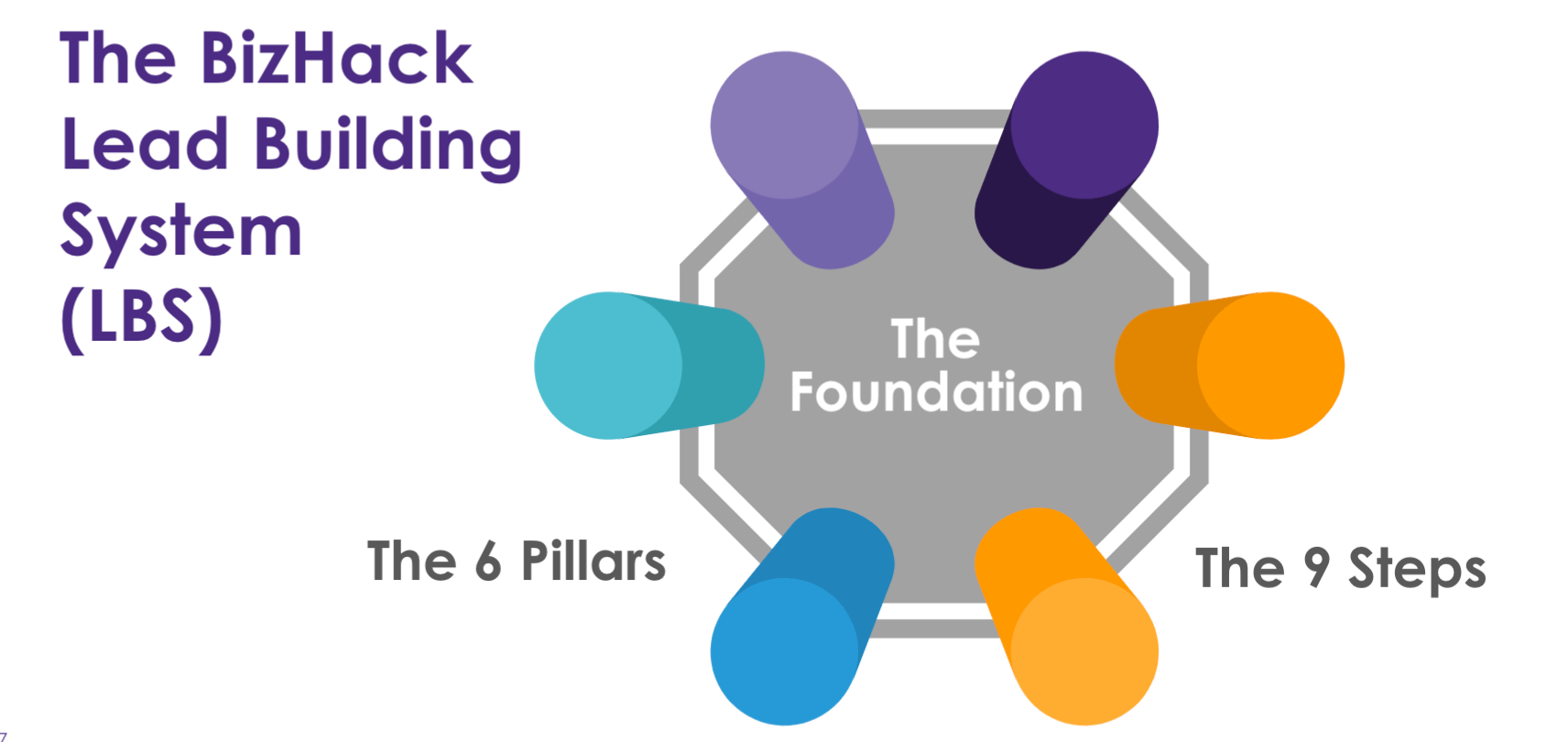

Digital marketing doesn’t need to be difficult. The BizHack Lead Building System™ is a proven methodology for small business marketing. BizHack founder Dan Grech developed the LBS over 7 years working with more than 700 small businesses around the world and across every industry. Take control of your small business marketing today, click here.